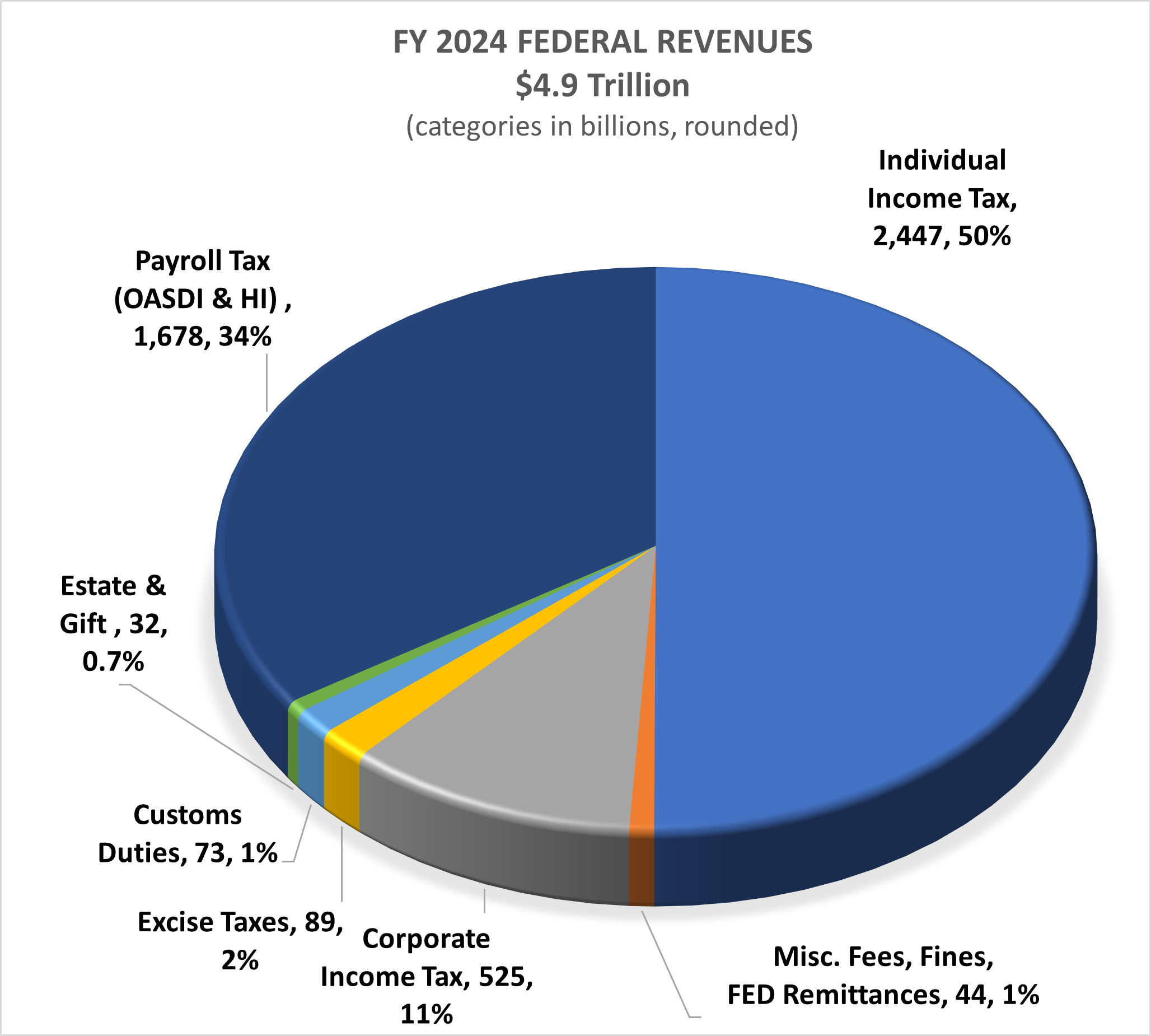

As displayed in the revenue pie chart below, federal revenues consist of governmental receipts from the individual income tax, payroll taxes, corporate income tax, federal reserve remittances, excise taxes, custom duties, and the estate and gift tax.

Federal revenues fall under the jurisdiction of the House Committee on Ways and Means and the Senate Committee on Finance—two of the oldest committees of Congress. Ways and Means was first established in 1789 and became a standing committee of the House in 1802. Finance became a standing committee of the Senate in 1816. Both committees have evolved into the most powerful committees of their respective bodies, with jurisdiction over taxes, tariffs and international trade, and nearly half of all federal spending, including Social Security, Medicare, and Medicaid. (Ways & Means shares jurisdiction over Medicaid with House Energy & Commerce.)

Congress’ revenue raising committees interact with the budget process in several important ways.

- The Finance and Ways and Means Committees evaluate all tax proposals contained in the President’s Budget.

- The congressional budget resolution includes a revenue floor. Any legislation from the tax-writing committees that would bring total projected federal revenues below the revenue floor is subject to a parliamentary point of order.

- The budget resolution may include reconciliation instructions to the Finance and Ways and Means Committees to report legislation that achieves specified amounts of revenue increases or decreases. If tax cuts are called for, they are constrained by the Senate’s Byrd Rule, which prohibits reconciliation bills from increasing deficits beyond the 10-year budget window. The effect of this restriction is to require, in effect, that tax cuts included in reconciliation bills expire after 10 years unless offset by spending cuts or revenue increases.

- Statutory PAYGO requires, in effect, that any new legislation that would reduce revenues, must be offset by spending cuts or revenue increases in order to avoid triggering a sequester, although Congress has routinely enacted provisions to escape this restriction, for example, the 2017 tax cuts.

- The House adopted a rules change in 2023 for the 118th Congress aimed at impeding tax increases by requiring a three-fifths vote to pass any measure that would increase federal income tax rates. (H.R. Res. 5 § 2(b), 118thCongress, amending House Rule XXI with a new clause 5(b).)

Data Source: Congressional Budget Office, Budget and Economic Outlook (June 2024)

- Income Tax: The individual income tax is the federal government’s largest source of revenue. The income tax is applied to income in seven brackets, from 10% applied to income of $11,600 or less ($23,200 for married couples filing jointly) up to 37% for income over $609,350 ($731,200 for married couples filing jointly). The income tax is projected to generate 50% of federal government receipts in FY 2024, or $2.5 trillion.

| 2024 Federal Income Tax Brackets | ||

| Tax Rate | For Single Filers | For Married Individuals Filing Joint Returns |

| 10% | $0 to $11,600 | $0 to $23,200 |

| 12% | $11,601 to $47,150 | $23,201 to $94,300 |

| 22% | $47,151 to $100,525 | $94,301 to $201,050 |

| 24% | $100,526 to $191,950 | $201,051 to $383,900 |

| 32% | $191,951 to $243,725 | $383,901 to $487,450 |

| 35% | $243,726 to $609,350 | $487,451 to $731,200 |

| 37% | $609,351 or more | $731,201 or more |

| Source: Internal Revenue Service | ||

- Payroll Taxes: Payroll taxes are projected to raise 34% of Federal revenues for FY 2024 — $1.7 trillion. Payroll taxes consist primarily of Social Security taxes and Medicare Hospital Insurance (HI) taxes paid by employers and employees, as well as Unemployment Insurance Taxes paid by employers. Most low- and middle-income taxpayers pay more in payroll taxes than income taxes. The Social Security and Medicare HI payroll tax rates are, respectively, 12.4% and 2.9%— half paid by the employer and half by the employee (i.e., 6.2% and 1.45% each), with self-employed individuals paying the equivalent of both halves. Wages subject to the 6.2% Social Security payroll tax are capped at $168,600 in 2024, with the taxable maximum adjusted upward each year to reflect increases in average wages. The Medicare HI tax, unlike the Social Security tax, is assessed on all income.

- Corporate Income Tax: A corporate tax of 21% is levied on corporate profits, i.e., taxable income after expenses have been deducted. The effective tax rate for corporations can be lower due to various types of deductions, subsidies, and tax preferences. Deductions include the cost of goods sold, general and administrative expenses, marketing, research and development, depreciation, and other operating costs. Companies opting to register as S-corporations do not pay corporate tax; instead, the income passes through to the business owners who are taxed through their individual tax returns. Beginning in 2023, the Inflation Reduction Act of 2022 imposed a corporate alternative minimum tax (CAMT) of 15% on the adjusted financial statement of large corporations (excluding Subchapter S corporations, regulated investment companies, and real estate investment trusts).

- Customs Duties: Customs Duties are assessed on specified imports. Revenue from customs duties increased in recent years following implementation of new tariffs of 10% to 25% on imports from certain countries of solar panels, appliances, steel, aluminum, and softwood lumber.

- Excise Taxes: Excise Taxes are usually created to fund specific government activities. Operationally, they are levied on the production or purchase of particular goods or service. Excise taxes on gasoline, diesel fuel, and ethanol, about half of all excise tax receipts, flow into the Highway Trust Fund to pay for highways, bridges and mass transit. Excise taxes on airline tickets, aviation fuels, and aviation transactions fund the Airport and Airway Trust Fund to pay for airport improvements and other aviation services. New excise taxes on hazardous substances are dedicated to the Hazardous Substances Superfund to pay for cleanup operations. Excise taxes on importers of brand-name drugs help to fund the Affordable Act. Other excise taxes to raise revenue are levied on tobacco and alcohol.

- Estate and Gift Taxes: Estate and Gift Taxes are widely misunderstood due to political hyping of a “death tax.” Estate and gift taxes comprise less than one percent of federal revenues and 99.8 percent of Americans are effectively exempt from the estate tax due to the large lifetime exemption amount, $13.61 million for 2024. For the 0.2 percent of Americans subject to the estate tax, a 40 percent tax is applied to property transferred at death above the $13.61 million exemption amount. The federal gift tax operates alongside the estate tax to prevent individuals from avoiding the estate tax by transferring property to heirs before dying. For 2024, the first $18,000 of gifts from one individual to another is excluded from taxation and does not apply to the lifetime exemption. However, any amount over this annual exclusion lowers the effective lifetime estate tax exemption.

- Miscellaneous Fees, Fines and Remittances: This category consists of miscellaneous fees, fines, and remittances from the Federal Reserve which includes income produced by the activities of the Federal Reserve System minus costs; most of this income results from interest on Treasury securities and mortgage-backed securities held by the Fed. This category also includes the Universal Service Fund fee which pays for expanding access to communication services, various user fees for government services, as well as fines and penalties.